Manufacturers have expanded their expectations about the benefits of digital transformation, but issues around workforce skills, organizational silos, and skittishness about embracing disruption may be holding some back.

By Paul Wellener and Mark Cotteleer

The focus on Industry 4.0 is often centered on the tremendous digital transformation it is driving throughout organizations, value chains, and society at large. Within manufacturing, the birthplace of Industry 4.0, that focus is further crystallized into enabling heart-of-the-business operations – like production and supply chains – to drive efficiencies (OEE) and calibrate supply and demand. However, in recent years, the aperture for the intent and impact of Industry 4.0 transformation has broadened to include areas like creating a more sustainable world.

In fact, Deloitte Global’s second annual survey assessing business readiness for the Fourth Industrial Revolution1 identified four areas where most companies are targeting their efforts, and those who take the right approach are seeing financial gains in parallel to the good they’re doing. The four areas highlight some of the challenges and opportunities many companies face:

- Strategy: Innovation and new business opportunities abound with Industry 4.0. However, the organizational silos in many companies are limiting leaders’ ability to develop and share knowledge to implement effective Industry 4.0 strategies.

- Technology: Industry 4.0 technologies can be game changers for organizations. However, as advanced technologies continue to be adopted, more often they are used to protect existing positions rather than making bold investments to drive disruption.

- Talent: The future of manufacturing is tightly coupled with the skills of the workforce that powers it. A gap is emerging between organizations’ commitment to create a workforce for Industry 4.0 and their confidence in their ability to upskill their current workforces.

- Societal Impact: Companies are making a genuine commitment to improve the world through Industry 4.0.

Before highlighting the opportunities available for manufacturers, it’s important to address the challenges in the list above (see figure 1), as they can inhibit true adoption of Industry 4.0. Examining their source and identifying ways to circumvent their negative impact can help manufacturing leaders make intentional gains on the pathway toward digital transformation.

Organizational Silos

As manufacturers seek to transform the way they deliver value to the market, the persistence of organizational silos can derail efforts to collaborate, communicate, and generate innovation. One third of manufacturers surveyed ranked organizational or geographical silos among their top three challenges in setting Industry 4.0 strategy. On a positive note, many manufacturers appear to be ahead of the overall response across industries in an important area: Industry 4.0 knowledge diffusion.

Fifty-two percent of manufacturing respondents cited that their organization’s Industry 4.0 technology knowledge was widely distributed across the leadership team, compared with only 40 percent of overall respondents. Knowledge diffusion is an important enabler to Industry 4.0 success, and it shows: executives whose organizations struggle with silos were less likely to say their technology investments have achieved or exceeded their intended business outcomes. For manufacturer respondents, 69 percent of respondents identified that their technology investments hit the mark.3

Focusing on protection is no-win game in the world of Industry 4.0’s transformational opportunities.

Protection Versus Disruption

Another persistent challenge for some organizations implementing Industry 4.0 is the presence of too many technology choices, making it difficult to keep pace with the rapid rate of change and understanding all the technology-driven opportunities. There is no doubt that the pace and volume of new Industry 4.0 technologies can be overwhelming to many organizations, especially industries like manufacturing, where many leading companies have been in business for decades or even centuries, rather than those companies born at the dawn of Industry 4.0. Too many technology choices is the second biggest challenge manufacturing respondents face in setting an Industry 4.0 strategy.4

Research conducted by the Manufacturing Leadership Council supports this finding. Sixty percent of respondents to the MLC’s Transformative Technologies survey, results of which were published late last year, said that the accelerating pace at which new technologies are emerging has caused them to fall behind in their efforts to evaluate and understand the potential of the technologies.

The noise in the market from the abundance of Industry 4.0 technologies can have several important effects on manufacturers. One of them relates to not being able to absorb the pace of new technology introduction. Half of manufacturers surveyed identified a “lack of understanding how to implement” as the greatest challenge with respect to investing in Industry 4.0 technologies.

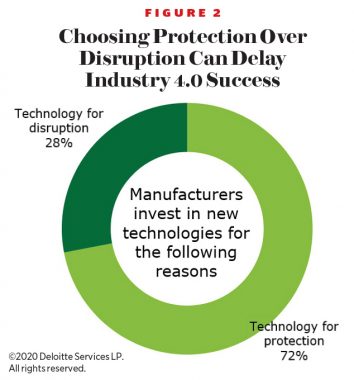

This challenge can lead to an even more potentially damaging outcome for manufacturing companies: choosing protection over disruption. Seventy-two percent of manufacturing respondents stated they invest in new technologies to protect their business from disruption, compared with 28 percent that invest in new technologies to disrupt the market.5 (Figure 2)

Focusing on protection is typically a short-term, no-win game in the world of Industry 4.0, which is defined by its disruption and transformational opportunities. Companies that merely adopt advanced technologies to digitize their existing processes without considering what new and better ways that technology can be used to reimagine their business are likely missing the point and could be at risk for being disrupted out of business by companies that do understand this important nuance.

The failure to understand this nuance has affected other industries that have embraced Industry 4.0 technologies, from hospitality to retail to transportation. Manufacturing appears on the precipice of disruption and choosing to invest in advanced technologies as part of that disruption is the most likely path forward to yield exponential outcomes.

The Talent Gap

In manufacturing, the ongoing challenge to find skilled talent has continuously ranked at or near the top of leaders’ concerns. In the National Association of Manufacturers’ (NAM) quarterly survey, it has been a perennial top challenge for manufacturers, supplanted only in the most recent May 2020 survey by the economic impacts of COVID-19.6 This is no surprise, as the Manufacturing Institute and Deloitte have been reporting on the ongoing skills gap in the industry over the past decade, right when Industry 4.0 technologies began to infiltrate production environments.7 And, even in the COVID-19 environment, with an unprecedented unemployment rate in the United States, 41 percent of manufacturers in the most recent NAM survey cited “attracting and retaining a quality workforce” as one of the biggest challenges they are facing right now.

Often, it is more appropriate to describe the current skills shortage in manufacturing as a mismatch between current skillsets and those that will be needed in the future. As advanced technologies are introduced that change the way work is done, they often require a skillset that is markedly different than the existing capabilities among many in the existing manufacturing workforce. Nearly two-thirds of manufacturing survey respondents reported knowing which skillsets their workforce will need in the future, but 67 percent believe they do not have the correct workforce composition and skillsets needed for the future.8 This mismatch could derail Industry 4.0 adoption, and manufacturing leaders are focused on solving this pressing challenge.

Finding the right talent in the midst of a talent mismatch is one aspect, but the importance of managing this change cannot be understated. Manufacturing leaders likely need to create plans for identifying where new skills are needed and ways to integrate these emerging roles into the work environment. Technology, including digital platforms, will also need to be introduced to support these emerging roles.

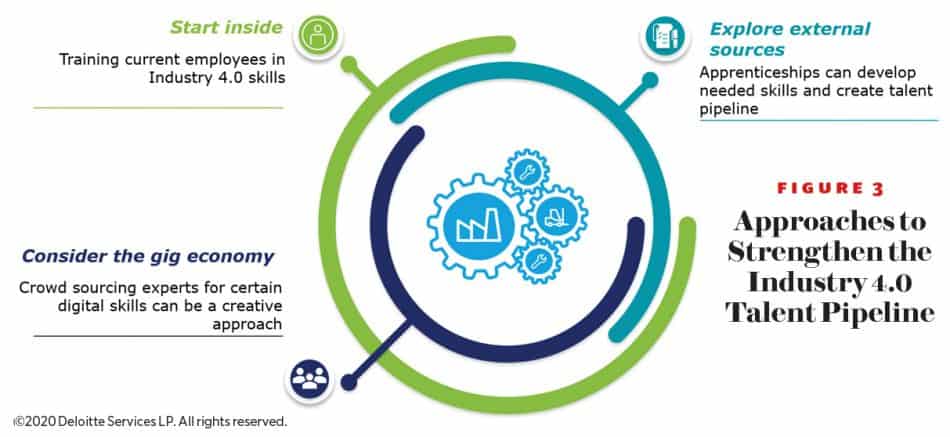

Among the approaches that manufacturers are taking to solve for the talent crunch, starting with their existing workforce is the desired pathway. Companies surveyed seem committed to training current employees in the skills they need, followed by efforts to create external training programs, such as apprenticeships, that develop needed skills and create a talent pipeline for the future that is imbued with Industry 4.0 capabilities. Interestingly, in a nod toward the disruption taking place across society through Industry 4.0, nearly two-thirds of respondents intend to crowd source experts for certain digital skills, and 71 percent would consider utilizing workers who are part of the gig economy.9 The talent challenges facing manufacturing are not expected to be solved quickly, but it’s encouraging to see how flexible and creative some manufacturers are willing to be as they contend with this ongoing challenge.

The ‘Social Super’ Persona

Given the potential obstacles to Industry 4.0 transformation, it can seem an insurmountable goal to reach. However, there are bright spots on the horizon. The global Deloitte 2019 Industry 4.0 Readiness Survey identified four personas of leaders who are finding strategic ways to advance their Industry 4.0 maturity. And, in doing so, they are growing faster (more than five percent annually) than their peers (32 percent versus 20 percent).10

One persona in particular seems to stand out and bears further examination. The study labels them Social Supers because they “do well by doing good” by generating new revenue streams through socially or environmentally conscious products or services. These leaders also believe that societal initiatives, more often than not, contribute to profitability. Social Supers see social initiatives as central to the health of their organization and exhibit confidence about doing good across a variety of areas:

- An appetite for disruption. Social Supers are more likely than others to invest in new technologies to disrupt the market and are confident in their ability to lead their organization in capitalizing on opportunities related to Industry 4.0.

- A skills-matched workforce. These leaders believe their workforce is prepared for Industry 4.0 and are committed to investing in training their workers to acquire the skills needed.

- More holistic and defined decision-making processes. Social Supers possess consistency around decision-making, including their ability to use data-driven insights in decision making and a preference for seeking input from diverse sets of stakeholders.

Based on the characteristics of Social Supers, breaking down organizational silos to disseminate Industry 4.0 knowledge, applying technology toward disruption for competitive advantage, and investing in upskilling their workforce appear to be key themes. Adding a social conscience to this rounds out the persona and highlights that manufacturers can be profitable even as they pursue societal initiatives.

The current skills shortage in manufacturing is a mismatch between current skillsets and those needed in the future.

The Faces of Progress

While the Social Super is an encouraging example of how leaders can make certain decisions related to Industry 4.0 adoption to advance not only their organization’s strategic goals but also society’s at large, there is more than one pathway toward Industry 4.0 success. The study identified a number of characteristics across all leader types (Figure 4). For executives still trying to define their approaches, these lessons could be helpful:

- Commitment to doing good. Ethical use of Industry 4.0 technologies is present across all leader types. And, as evidenced above, this can result in societally-driven products that deliver value and create new revenue streams.

- Clearer vision of the path forward. These leaders are tuned to using data-driven insights and following clearly defined processes to make decisions. The results are putting them ahead of their peers.

- Longer-term lens on technology investments. Leaders across types balance efforts between finding incremental gains from short-term initiatives and investing in Industry 4.0 technologies to disrupt their markets. These executives are not content to play a protection game.

- Leading with workforce development. These leaders embrace the potential in their existing workforce and strive to create opportunities for upskilling and training on Industry 4.0 capabilities.

The evolution of a clearer path toward Industry 4.0 success is present in many of the stories from executives interviewed as part of the study. Many leaders express a more tempered perspective that recognizes the many dimensions of Industry 4.0, including its challenges. Making targeted progress toward breaking down organizational silos to drive collaboration and knowledge dissemination, using technology for disruption rather than protection, and investing in the workforce to imbue them with the skills needed to capitalize on the fourth industrial revolution are all ways that today’s leaders are acting to gain success and prepare for the future. M

1 Punit Renjen, “Success personified in the Fourth Industrial Revolution,” Deloitte Insights, January 19, 2019. https://www2.deloitte.com/cn/en/pages/energy-and-resources/articles/success-personified-in-the-fourth-industrial-revolution.html

2 ibid

3 ibid

4 Ibid

5 Ibid

6 NAM Manufacturers’ Outlook Survey, Second Quarter 2020, May 28, 2020. https://www.nam.org/wp-content/uploads/2020/05/NAM-2020-Q2-Outlook-Survey.pdf

7 Paul Wellener et. al., 2018 Skills Gap and Future of Work in Manufacturing Study, Deloitte Insights, October 2018. https://www2.deloitte.com/content/dam/insights/us/articles/4736_2018-Deloitte-skills-gap-FoW-manufacturing/DI_2018-Deloitte-skills-gap-FoW-manufacturing-study.pdf

8 Punit Renjen, “Success personified in the Fourth Industrial Revolution,” Deloitte Insights, January 19, 2019. https://www2.deloitte.com/cn/en/pages/energy-and-resources/articles/success-personified-in-the-fourth-industrial-revolution.html

9 Ibid

10 Ibid