Data: The New Differentiator

Most manufacturers tend to view the value of their data in terms of its use in optimizing operations. But by managing data as a strategic business asset, its value could be much greater.

“Data is the new oil.” It’s a phrase we hear with increasing frequency in many business contexts. Companies across multiple industries now view data as increasingly essential to their success and market advantage. Data today, like oil over the last hundred years, is increasingly a source of wealth, power, and success, and a driver of the emerging digital economy.

But there are differences. When oil is gone, it is gone. Yet data generates more of itself and can be used multiple times for multiple purposes. Data is also cheaper to store and easier to transport. But it’s also easier to be stolen and is impossible to clean up if you spill it.

Data is also potentially more valuable. Companies with certain data characteristics that behave in data-driven ways generate economic benefits and have value beyond others. Investors now tend to favor data-centric companies. Research shows data savvy companies, such as those with a chief data officer, a data science team, and an enterprise data governance function, have twice the market-to-book value as their peers.1 Data-product companies, for which data or digital products are the primary offering, have three times the market-to-book value. Further, data for some organizations might actually be worth more than the value of the company itself.2

Maximizing Data Potential

Manufacturers have access to and use data from many sources: customers, equipment, processes, transactions, quality, IoT or streaming devices, and more. They’re also generating and acquiring more of it by the day. According to the Manufacturing Leadership Council’s (MLC) first survey on M4.0 data, conducted in March 20203, more than a quarter of manufacturing companies surveyed said they their manufacturing data volumes doubled or tripled in size over the previous two years. Looking ahead, over a quarter of companies expect data volumes to surge by more than 500% over the next two years.

But what are they doing with it, and to what extent are they using it to drive enterprise value? Manufacturers most commonly associate the value of their data with its use in optimizing operations. The MLC study validates this: 54% of participants said they measure the value of data in terms of the impact on operational performance, driving value by managing cost of goods sold; maximizing on-time in-full (OTIF); increasing capacity and labor productivity in light of labor and material shortages; or improving performance in productivity, efficiency, or quality.

Lockheed Martin, for example, recognized it could use data to proactively predict program health and apply course correction measures before problems arose. The company correlated and analyzed hundreds of structured and unstructured metrics for thousands of programs to identify a concise set of leading indicators of program performance. The analysis even uncovered specific words from a program manager’s comments that are predictors of a program downgrade. This increased program foresight by three times, facilitating earlier program assessments. Ultimately, the company was able to avoid hundreds of millions of dollars in losses due to program delays4.

Optimizing operations, of course, is one way to create value from data. But this is only a steppingstone in the journey toward maximizing its potential value. That requires treating data as an enterprise asset—a real mindset shift for many organizations, particularly in manufacturing.

In fact, this mindset is particularly important given the new realities brought on by pandemic-accelerated changes to the manufacturing workplace and workforce, as well as shifts in customer demand that require manufacturers to be able to change up operations faster than ever. Manufacturers that are only using descriptive analytics to fine-tune operations will quickly fall behind those able to use prescriptive or predictive insights to adapt their operations to the velocity of the market and drive profitability.

Accountants may not recognize data as an asset on the balance sheet, but that doesn’t mean companies can’t begin managing it as one. Manufacturers are already adept at managing physical assets, so treating data with the same care shouldn’t be too much of a stretch. Infonomics, the emerging discipline of managing and accounting for information with the same or similar rigor and formality as other traditional assets—offers a useful framework for driving greater value from data. It consists of three key elements: monetizing, managing, and measuring data value.

1. Monetize Data

Maximizing the value of data begins with looking at it in terms of its economic benefits. There are many directions this can take. Direct monetization includes bartering or trading with data, selling raw data through brokers or data markets, or selling insights or analysis. But monetization is about more than selling data assets. It instead comprises any and all ways that available data can generate new value streams for an organization, both internally and externally. Indirect methods of monetization include improving process performance and effectiveness (as in the Lockheed example), developing new products or markets, enhancing/digitalizing products and services with data, and forging and streamlining partner relationships. Mastering indirect monetization can, in fact, lead to greater direct monetization.

The best way to illustrate potential applications to manufacturing is through stories and examples, and there are plenty of them.

Creating new revenue streams: Sometimes selling information is a preferable alternative to no revenue at all. When a mid-sized U.S. manufacturer of sonic buoys and other inertial sensors recognized it was losing business to lower-cost manufacturers in Mexico and elsewhere, it licensed its expertise in the form of detailed manufacturing and testing processes to those who would otherwise undercut them. Competitors became partners, and a new revenue stream materialized5.

Transforming the business model: Rolls-Royce was an early pioneer of this concept with its Power-by-the-Hour offering, which it has continued to build upon. The company’s CorporateCare® program, originally launched in 2012 and enhanced in 2018, uses onboard sensors to track on-wing performance and facilitate maintenance6. More manufacturers are moving to a product-as-a-service (PaaS) model, which is dependent on data. For example, Michelin’s EFFIFUEL™ is a PaaS offering targeting commercial vehicles, particularly trucks, using IoT data to improve performance7. The offering uses sensors inside vehicles to collect data about fuel consumption, tire pressure, temperature, speed, and location. A Michelin team then analyzes the data to provide recommendations for fuel-efficient driving. This has led to higher customer satisfaction, loyalty and retention, and increased profits.

Driving value from mergers and acquisitions: When Stratasys purchased MakerBot, a startup manufacturer of desktop 3D printers, in 2013, it also acquired MakerBot’s established 3D printing ecosystem, which continuously develops new applications for 3D printing. This effectively enabled Stratasys to crowdsource research and development data from the community and reduce its own in-house R&D costs8.

Responding rapidly to change: With a $2 billion orange juice business, The Coca-Cola Company must be able to minimize product inconsistencies due to variations in orange crops, sourcing, and seasonality. The company’s Black Book model algorithm, developed by Revenue Analytics, crunches data from up to one quintillion data points, including satellite images, weather, expected crop yields, cost pressures, regional preferences, and detailed data about the 600 flavors that comprise an orange, plus variables such as acidity and sweetness. The result is a precise formula for how to blend orange juice for consistent taste, including pulp content. After a hurricane or freeze that affects crops, the company can replan in 5 to 10 minutes9.

Monetizing data to achieve these types of impacts requires structure and discipline, but also sufficient space for exploration on the front end. It’s helpful to start with workshops designed to conceive and refine ideas for innovating with information to drive new value streams. For the broadest thinking, try to get business leaders, data architects, subject matter experts, and ideally representatives of key customer, supplier, or partner segments into a room together. Inspire them with other data monetization examples from inside and outside the organization and industry. Then allow them to explore available data sources and potential insights and/or external value within or at the intersection of those data sources. Ask questions like: What could we accomplish if we had additional data? What types of external data sources would enable that? Where could we add new sensors or OT sources to generate additional data that may provide valuable insights?

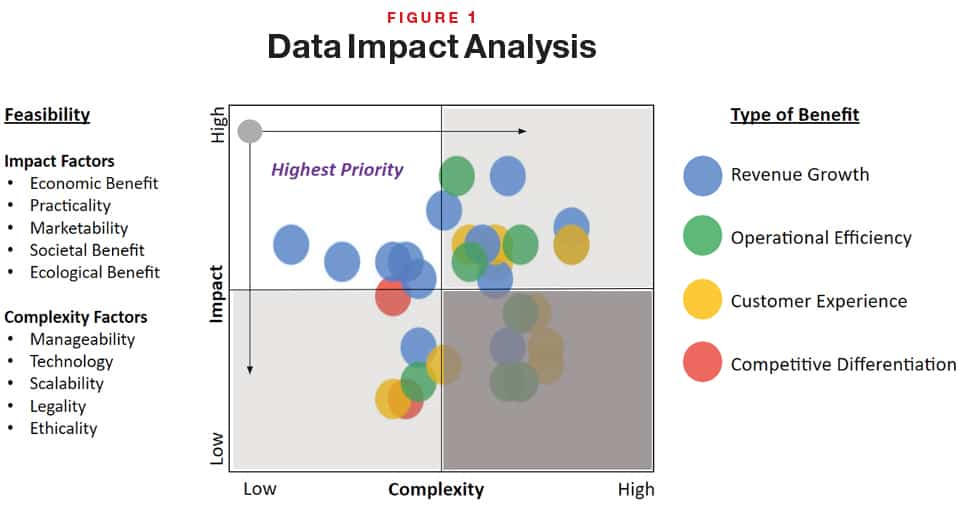

Then assess the ideas generated based on feasibility in order to prioritize those to be developed. This assessment should include a range of include impact factors such as economic benefit, practicality, marketability, societal benefit, or ecological benefit. The feasibility assessment should also consider the complexity involved, including manageability, technology, scalability, and ethicality. It’s important to make sure you vet the financial and systemic impact, as well as scalability, from a true operational perspective in an applied setting.

2. Manage Data as an Asset

Realizing value from data requires proven asset management principles and practices. In this context, that includes data science capabilities as well as enterprise data governance function and principles. But none of that will matter without the right leadership.

Our research has found that organizations with a chief data officer with the right level of influence, authority, and resources, reporting to the CEO or at least with a spot on the executive team, are four times more likely to be using data to transform business processes, products, or services10. They are also three times more likely to generate non-monetary commercial value and seven times more likely to generate monetary value from data externally.

By contrast, organizations where the CIO still maintains ultimate responsibility for the company’s data assets are only half as likely to be employing advanced analytics. In organizations without empowered CDOs, data quality and availability continue to be significant impediments to analytics.

Manufacturers should take note. From the results of the MLC’s M4.0 data study, it appears they have some significant catching up to do. Only 7% of companies participating in that survey reported having a CDO who is responsible for data governance and strategy. Rather, most place data responsibility with an information technology (IT) head (the CIO or IT VP) or a joint IT/OT team. Further, 18% have no one with data governance responsibility and more than half of the participants in the study said they do not have any corporate strategy, guidelines, or plan for the way data is collected or organized across their companies. Only 18% believe their company is “very capable” of analyzing the data it has.

Establishing true responsibility and accountability for all things data is the essential place to start. Once that is in place, you can then begin developing plans for maturing data and analytics capabilities across various areas, including strategy, technology and architecture, organization and skills, literacy, and culture.

3. Measure and Improve Data’s Potential

You can’t manage what you don’t measure. Organizations tend to manage data volumes and speed, but most are missing the bigger picture. Few measure data quality characteristics such as potential value, business relevancy, cost, impact on business performance, market value, and impact on the organization. For example, research shows that only 11% of organizations know the cost of their data, 12% calculate the financial value of their data assets, and 21% measure the business impact of data quality improvements11. Only 4% have developed ways of measuring data value in monetary terms with an assigned dollar value, and only 7% are now beginning to measure data value against data-driven services. Thirty percent do not have measures in place to value the increasing volumes of data that digital technologies create. On the other hand, companies with executive-level CDOs are three to four times more likely to formally measure the value of the company’s data assets.

To help gauge and improve data’s economic characteristics, companies should start by recognizing the three degrees of data value: realized, probable, and potential. The latter reflects the value that could be derived by applying data to all relevant business processes. Proper information valuation should include both foundational measures that can help improve information management discipline: the intrinsic value of information (how correct, complete, and scarce is this data?), business value of information (how good and relevant is this data for specific purposes?), and performance value of information (how does this data affect key business drivers?). Information valuation should also consider financial measures that can help manage and improve information’s economic benefits: cost value (what did it cost to collect this data, or if we were to lose it?), market value (what could we get from selling or trading this data?), and economic value (how does this data contribute to revenue/expense savings?).

Generating Value

Manufacturers now have significant opportunity to understand and take advantage of data’s unique economic characteristics. The good news is that they recognize this. All respondents to the MLC study said they believe data is either essential or supportive to their future competitive success.

This represents a substantial transformation for many manufacturers, but it is possible, and positive examples are out there. In fact, in all of our research, it was a manufacturing company, Textron, the parent company of Bell Helicopter and Beechcraft, Cessna and maker of other specialized technology products, that stood out as embracing the possibilities and potential of value of data so well12.

“We no longer differentiate ourselves primarily via the performance of our products. Rather, we gain advantage from our ability to monitor enormous amounts of data from inside and outside our business, find insight in that data and act on it more quickly than our competitors,” said the company’s director of global ERP and analytics at the time. “Our finance people used to chuckle about the idea of information as an asset, the reality is that for most employees, our business is data: 70 percent of our employees don’t touch aircraft, but everyone touches data.” M

Footnotes:

1 Infonomics: How to Monetize, Manage, and Measure Information as an Asset for Competitive Advantage, page 211, Douglas B.Laney, 2017

2 https://www.forbes.com/sites/douglaslaney/2020/07/22/your-companys-data-may-be-worth-more-than-your-company/?sh=66c83bee634c

3 “The Key to Future Competitiveness: M4.0 Data Mastery,” Manufacturing Leadership Journal, Paul Tate, April 2020; https://www.manufacturingleadershipcouncil.com/m4-0-data-mastery-the-key-to-future-competitiveness-11805/

4 Infonomics, pg. 42

5 Infonomics, page 32

6 https://www.rolls-royce.com/media/press-releases-archive/yr-2012/121030-the-hour.aspx

7 Emad, “Michelin: Tires-as-a-Service,” digital.hbs.edu, November 17, 2016

8 https://www.forbes.com/sites/kellyclay/2013/06/19/3d-printing-company-makerbot-acquired-in-604-million-deal/?sh=4b45c98e1ef8

9 Infonomics: pages 83-84

10 https://mitsloan.mit.edu/ideas-made-to-matter/making-business-case-a-chief-data-officer

11 “The Business Case for the Chief Data Officer,” Douglas B. Laney, MIT Chief Data Officer and Information Quality Symposium, 2001

12 Infonomics: page 292