Prioritize to Thrive: M4.0 as Recession Antidote

Technology investments can help manufacturers fuel growth as economic headwinds build.

Manufacturers have long known about the benefits of investing in Industry 4.0 improvements. As economic headwinds build, business leaders face a difficult choice about how to prioritize capital investments. In many cases, costly, long-term projects will be put on the backburner in favor of quick wins that can deliver a rapid return on investment.

At the same time, challenges related to supply chain disruption, labor shortages and heightened customer expectations persist. Industry 4.0 initiatives can help address those challenges, but organizations will need to prioritize spending as economic uncertainty constrains investment.

Supporting strategic business goals can be a guiding principle for how to prioritize investments. Digital strategy is a component of business strategy, and Industry 4.0 projects need to align with broader business objectives. Rather than being a technology exercise, digital initiatives should be business enablers that are tied to enabling competitive advantages or addressing tactical needs.

“Rather than being a technology exercise, digital initiatives should be business enablers.”

As recessionary pressures squeeze manufacturers, many businesses respond by looking to optimize costs and scale back investment, but it’s critical to seek targeted efficiencies and not undercut key areas that support revenue generation, revenue protection and competitive advantage. Now is the time to adapt and make the strategic adjustments necessary to support the business and set it up for growth when market conditions improve.

Evaluate your current state, prioritize planned capital investments, and assess your workforce and culture to understand where organizational value comes from. Then you can plan beyond the downturn and accelerate through the turn.

Prioritize Your Industry 4.0 Initiatives

Whether a business is thriving, merely surviving, or somewhere in between, an economic downturn requires prioritization across the business. Unfortunately, manufacturers that have delayed implementing Industry 4.0 may find it more difficult in the months ahead due to recessionary pressures alongside continuing supply chain disruption and workforce challenges.

BDO’s 2022 Manufacturing CFO Outlook Survey found that 30% of manufacturers surveyed have not yet started implementing Industry 4.0, so they are behind the curve in technology adoption compared to their peers. Additionally, half of all respondents say falling behind on innovation is a significant business risk. That clearly signals the need to continue investing in innovation, but all innovation is not equal. During a time of constrained resources, businesses should prioritize projects that have a clear path to implementation and can enhance revenue, profitability, competitive advantage, and future readiness.

Amid recession concerns, there can be a tendency to pull back on spending across the board and focus on cost cutting. However, if those steps are not taken carefully, they can hamper success by disrupting key business objectives. Reducing, delaying, or halting Industry 4.0 investments can have a cascading effect across an organization that increases risk, exacerbates the impact of risk, reduces resilience, and slows recovery from a downturn. It’s important to make targeted reductions in spending and continue investing in necessary projects while eliminating redundancies to create efficiencies.

Determining What Matters

Prioritization will vary between companies depending on several factors:

- The nature of the business

- Projects currently in flight

- Areas of greatest need

Despite these variations, the process of rationalizing a business portfolio is generally similar.

First, identify the mandatory projects that must continue. You cannot stop those because they are integral to the business, whether because they support revenue enhancement or preservation, customer satisfaction, an indispensable capability or other vital areas.

Then, assess where ROI will come from and how to accelerate quick wins. This step can include conducting a scenario analysis on expected timelines, project costs and projected value. Other initiatives can be put on hold temporarily, or even scrapped entirely, depending on how they fit with broader strategic goals. Once you’ve decided what initiatives to forgo and what to proceed with, you can continue investing in the mandatory projects and prioritize among the remainder.

“During a time of constrained resources, businesses should prioritize projects that can enhance revenue, profitability, competitive advantage and future readiness.”

For example, consider a large manufacturer that conducts quality control by relying on workers to make manual inspections of its products. That process draws substantial resources that could be devoted to other high-value activities. Alternatively, the company could invest in computer vision that is trained to identify common issues and automate a substantial portion of quality control tasks. Whether or not that investment is a priority for the specific business depends on several unique factors, especially cost, but the upside is clear: It will modernize an important process, free up more internal resources, and potentially improve customer satisfaction.

Establishing a Criteria

The process of prioritizing Industry 4.0 spending goes beyond just determining what is mandatory and what is optional. It requires defining the criteria for ranking priorities.

You can evaluate each project in terms of the monetary upside, strategic fit, required investment, and ease of implementation. Bear in mind that growth typically comes from geographies, business models, customers, and products. Anything that aids short-term revenue and profitability should be supported in the face of recessionary pressures. These considerations can include initiatives that improve customer retention, margins, or deliver a clear competitive differentiator. Some investments may be low-cost and easy to implement, such as installing IoT devices on a factory floor that monitor equipment and inventory to provide real-time information. Those quick wins should be captured as soon as possible.

There may be tradeoffs among competing considerations. For example, a project with significant monetary upside and strong strategic fit may require more investment, but that could be worthwhile even during lean times, especially if it carries strong revenue potential, which begins materializing in the near-term. And in other cases, there may not be alternative options, such as if a legacy system has reached the end of its useful life. Anything broken must be repaired or replaced.

“Long-term investments can be risky during uncertainty because pausing mid-flight can prove even more costly depending on the delay.”

Any capital-intensive investments will be scrutinized closely, so the expected benefits need to be clear, as well as the timeline for realizing those benefits. By contrast, projects that do not fit well with broader business strategy or do not carry notable monetary upside should be postponed. As one example, switching to a new ERP system, while strategically useful, can be a slow and costly process. Many businesses may choose to delay switching their ERP until there is less uncertainty regarding the future outlook.

The exception would be if there is a compelling reason to proceed with a certain project. For instance, if a large company you supply to changes systems or has new system requirements that vendors must meet, then you will need to upgrade your systems to continue working with that major partner.

It is important to bear in mind that projects which have known hurdles for implementation, or a long timeline for implementation, may be difficult to devote sufficient internal resources to when the main focus is on priority areas. Long-term investments can be risky during uncertainty because pausing mid-flight can prove even more costly depending on the delay.

The Importance of Culture and People

The success of Industry 4.0 relies on your people. A strong culture that is built on shared purpose and embraces innovation is one of the greatest organizational assets a business can have.

The more end-to-end understanding of processes that exists across the entire organization and workforce, the more aligned employees will be with change. Think of the mentality between management and workers as “create change with us” as opposed to “do what we say.”

“Using technology to automate repetitive tasks and providing upskilling of employees creates greater value to the employee and to the organization.”

Working together makes the work easier. And with that mentality, the workforce can also be a valuable source of intelligence to help guide Industry 4.0 investments in areas that eliminate redundancy, clear bottlenecks, and create greater efficiency. Additionally, a siloed organization will struggle to devise alternative solutions because they lack visibility and cross-functional understanding. If an organization is not siloed, then workers can better help devise best practices for alternatives.

Overall, companies that have a strong culture and a track record of participating actively in large transformational change programs have a much better chance to thrive. That is true for any program, not just during a downturn.

Overcoming the Talent Shortage

All too often, digital transformation efforts fail or fall short of their goals. Common reasons for this include employee pushback, change fatigue, poor change management, low digital literacy, and a lack of enablement and adoption. A culture that embraces change helps set up an organization for Industry 4.0 success, but that can be undercut by a separate workforce challenge: turnover and too few skilled workers to fill open positions.

Even before the challenges of the COVID-19 pandemic — and the related supply chain disruption and talent shortage across industries — manufacturers faced a workforce crisis. A 2019 survey by the National Association of Manufacturers found that nearly a quarter of the industry’s workers were age 55 or older. Those workers have only gotten older since then, and the U.S. population as a whole is skewing older as well. The U.S. Census Bureau noted in 2020 that the number of Americans aged 65 and older increased by 34% between 2010 and 2019 as more Baby Boomers pass retirement age.

On one hand, an aging workforce is a repository of critical knowledge, but on the other it poses a significant business risk. A lack of knowledge transfer could sap revenue and impede manufacturers’ growth trajectory. Older workers may opt to retire rather than undergo upskilling or reskilling for new systems, and the talent pipeline is struggling to keep up with replacing them. By some estimates, there could be millions of unfilled positions across the U.S. manufacturing industry by 2030.

These challenges will require a mix of solutions to leverage technology, strengthen culture, improve the talent pipeline, and modernize job roles to match available skill sets. Using technology to automate repetitive tasks and providing upskilling of employees creates greater value to the employee and to the organization. Identifying and enabling the highest and best use will drive efficiency through a diminished workforce.

“It is critical to communicate clearly and consistently with the workforce to identify concerns and anticipate emerging risks.”

At the same time, recession fears and cost cutting can leave workers worried that they could lose their jobs. Whether those concerns are justified or not, even the prospect of furloughs or layoffs can negatively impact employee engagement, which saps productivity. Businesses that rely on workers as a reserve of institutional knowledge are even more vulnerable to engagement and morale issues. So, it is critical to communicate clearly and consistently with the workforce to identify their concerns and anticipate emerging risks. Conducting a voice of the employee survey can also help gain better insight into employee morale, especially during times of change and uncertainty.

Revising the Value Drivers

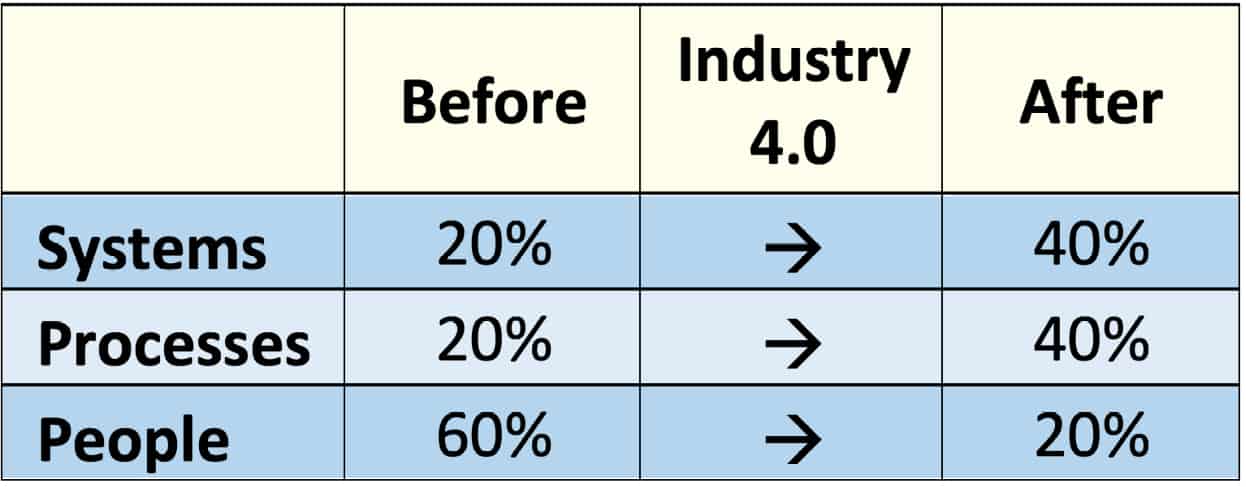

In addition to revenue generation, business leaders consistently seek to minimize risk and enhance future readiness. One way to help achieve that is by improving the performance of systems and processes, which helps increase the proportion of value they generate for the organization.

In many organizations, processes and knowledge reside with a company’s people, who rely on first-hand knowledge built through experience. They may frequently need to intervene and circumvent problems with systems, so most tasks cannot be done without significant involvement by workers. Systems may resemble paper forms — or work may even be done through actual paper forms. A lack of clear processes for task management, routing and prioritization can also create redundancy that saps efficiency and output. Therefore, people provide the greatest proportion of value under these circumstances, and the business faces outsize risk from turnover or other workforce disruption.

Fortunately, improving business systems and processes can reduce that overreliance on people and potentially free up internal resources for higher-value tasks. Then, people can create competitive advantage instead of solving unnecessary problems and triaging the breakdowns.

Figure 1: A rough illustration of how organizational value is distributed among systems, processes, and people, and how Industry 4.0 investments can help reduce risk by bringing added value into greater balance.

Standardization of systems and processes — in terms of real-time availability of required information, clear rules for task completion and full workflow functionality — reduces labor-intensive, customized methods that were developed ad hoc. It can also increase employee engagement by reducing a common source of frustration.

On the revenue side, more automation and Industry 4.0 maturity leads to better decision making. It enables better visibility into the business and potentially spotlight cross-silo KPIs. Your processes likely extend across multiple companies and include vendors and other partners, some of which operate in the cloud and others on-premises. Digital maturity can enable cross-company KPIs to build end-to-end visibility. Better information yields better decisions that can unlock strategic value, and Industry 4.0 is the key.

Planning Beyond the Downturn

Competitive advantage hinges on the ability to access data about your business and your customers. Companies that have a higher degree of Industry 4.0 maturity will be in a stronger position for enduring recessionary pressures and workforce challenges. They can access better insights about the business and make better decisions for the short and long terms, enabling a swifter exit from any downturn and a recovery at a higher velocity. By prioritizing Industry 4.0 investments to align with strategic business priorities, manufacturers can focus available resources on the highest value activities, maximize the short-term ROI they can achieve, and enhance future readiness. M

About the authors:

Maurice Liddell is a BDO Digital Market Leader, Manufacturing, with BDO USA LLP.

Dimitrios Vilaetis is a Managing Director, Management Advisory Services, with BDO USA LLP.

.