The Best Tool for Employee Retention? Listening to Them

Soliciting feedback is key to bridging the gap between what workers want and what employees offer.

TAKEAWAYS:

● Compensation, health care and retirement perks are typically the top priorities of what employees want most, regardless of industry.

● Giving employees a clear framework for defining their career paths could be one area ripe for improvement.

● Employees want opportunities to be heard, and for their employers to take their feedback into consideration.

Manufacturers have been grappling for years with how best to fill thousands of job openings on factory floors and white-collar positions, and economic headwinds are only adding more challenges to hiring within the sector.

As of March, the manufacturing sector contracted for the fourth consecutive month, according to data from the Institute for Supply Management. Also in late March, the RSM US Manufacturing Outlook Index—a composite index based on surveys of business sentiment conducted by six regional Federal Reserve banks—showed manufacturing activity was 1.8 standard deviations below normal. RSM’s index can be considered representative of the general direction of national manufacturing activity.

“That slowing leads us to think that firms will do their best to hold onto their workforce, minimizing the loss of employment in the coming quarters even if there were to be a recession,” RSM Chief Economist Joe Brusuelas wrote in an article that month.

“A recent survey reveals where employee priorities lie and generational nuances within the workforce — valuable insights that can help manufacturers boost retention.”

One aspect of addressing recent hiring challenges may seem obvious: Companies should listen to what employees say about their priorities and what they want most from their jobs. Proprietary data collected by advertising, technology and data company Big Village on behalf of RSM US LLP in 2022 reveals where those priorities lie and generational nuances within the workforce — valuable insights that can help manufacturers develop strategies that can boost retention for the increasingly digital factories of the future.

Understanding Employee Priorities

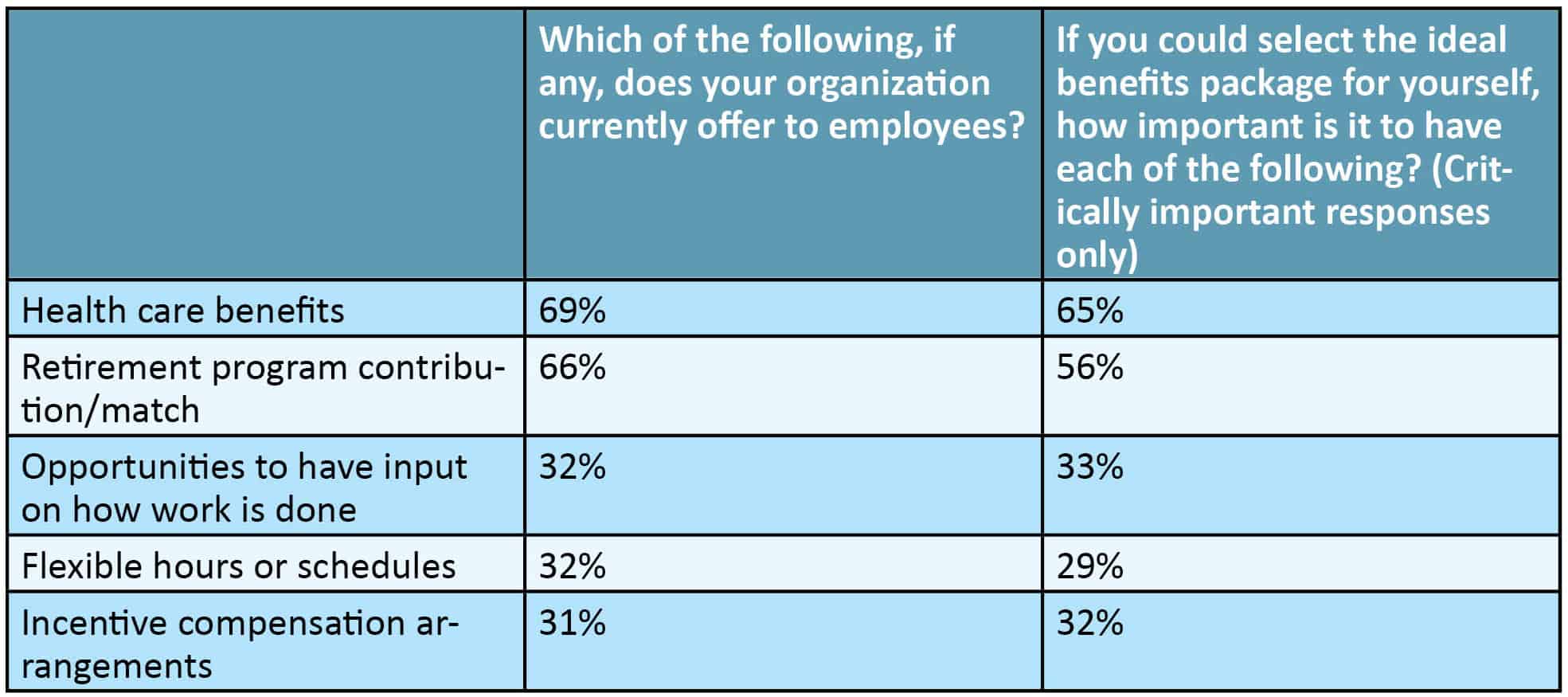

Compensation, health care and retirement perks are typically the top priorities of what employees want most from their employers, regardless of industry. But data from the Big Village and RSM survey shows how manufacturing sector respondents value the benefits their organization currently offers, compared to the importance of various benefits if respondents could create their ideal benefits package.

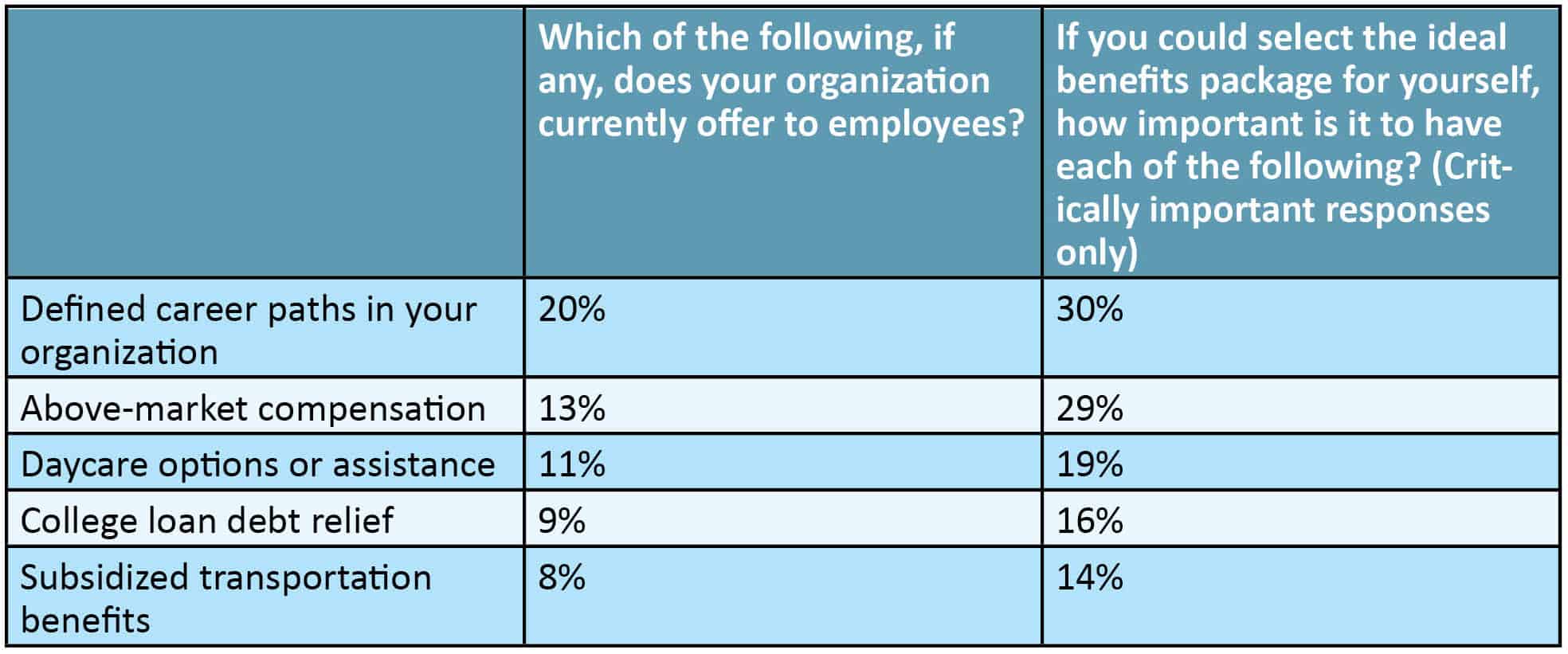

For instance, 29% of manufacturing sector respondents said above-market compensation would be critically important in their ideal benefits package, but only 13% of respondents said their employer offered such compensation. (The online survey was conducted among a sample of adults ages 18 and older in the United States who reported having at least one job.)

In numerous categories, the number of respondents who said their organization currently offered a given benefit was comparable with the number who said that benefit would be part of their ideal compensation package (Figure 1).

Figure 1: Manufacturing Sector Respondent Answers, RSM US Survey

For some categories, though, the gap between what the employer currently offered and what would be in the ideal benefits package was wider (Figure 2).

Figure 2: Manufacturing Sector Respondent Answers, RSM US Survey

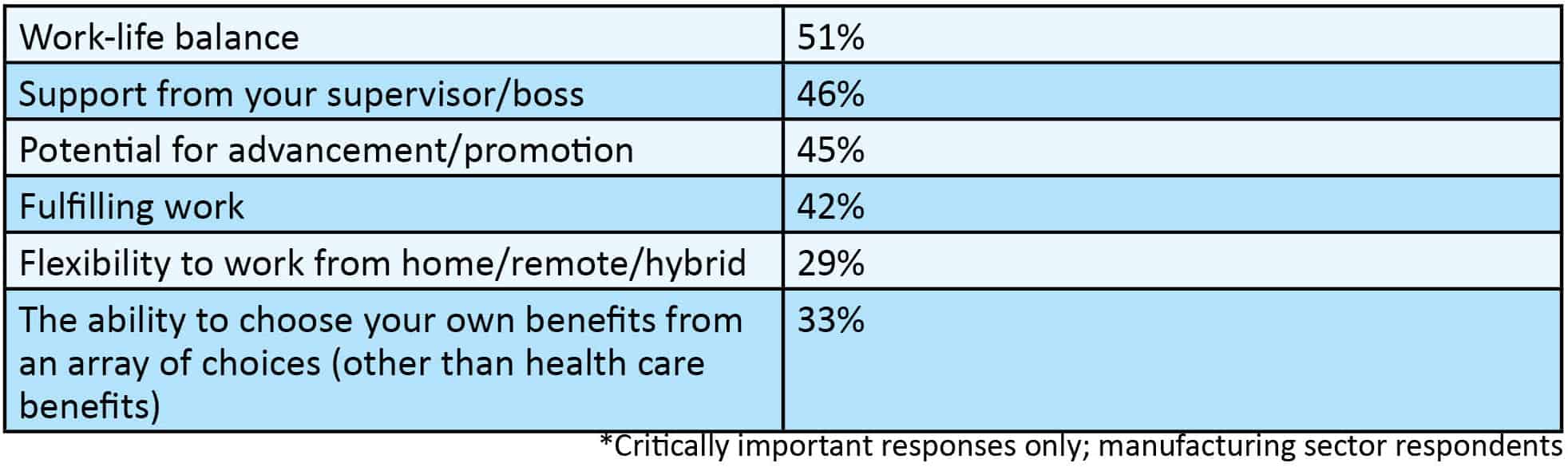

Along with competitive compensation packages, the data seems to indicate that giving employees a clear framework for defining their career paths could be one area ripe for improvement. Responses to other parts of the survey underscore this further; manufacturing sector respondents said that if they could have the ideal job, the three most important factors would be work-life balance, support from their supervisor/boss, and the potential for advancement/promotion (Figure 3).

Figure 3: If you could have the ideal job, how important of a role would each of the following play?*

For an accurate assessment of employee priorities and desires, manufacturers might consider conducting a similar survey among their teams. Leadership teams can then use the resulting data to develop or adjust employee compensation and benefits packages, rather than guess what workers want.

Generational Shifts

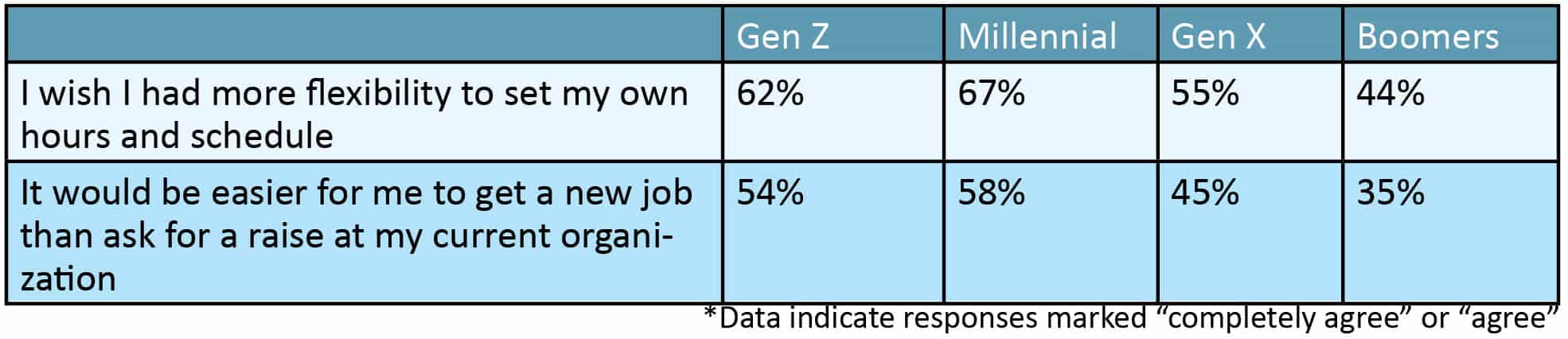

Understanding millennial and Gen Z perspectives on their jobs and employers will also become increasingly important as the presence of those cohorts rises in the labor force. Among all respondents — including those in the consumer products, technology, business and professional services, construction, financial services, and other sectors — significantly more members of the Gen Z and millennial cohorts wanted flexibility compared to their older counterparts.

Figure 4: To what extent do you agree with the following statements?*

Millennials were also significantly more likely than others to report:

- They would recommend their current organization to a friend (52% vs. 37% Gen Z, 43% Gen X, 37% boomers)

- Employee recognition programs are a critical benefit (32% vs. 24% Gen Z, 25% Gen X, 13% boomers)

- Consistent feedback on their performance is critical (36% vs. 27% Gen Z, 26% Gen X, 16% boomers)

- Collaboration with co-workers is critical (39% vs, 30% Gen Z, 28% Gen X, 21% boomers)

- Gen Z and millennials are significantly more likely than Gen X and boomers to report that they were actively applying for a new job/role, with 24% of Gen Z respondents, 30% of millennials, 14% of Gen X respondents and 6% of respondents in the baby boomer generation.

Those figures—even though they are respondents from all industries, not just manufacturing—should make clear just how important retention efforts are for any business.

Workforce Ownership in the Factory of the Future

Manufacturers need to respond to what workers want and give them a clear path for success if they aim to build a workforce that has longevity and adaptability for the future. Here are some of the most important areas we believe companies should zero in on:

- Flexibility: The pandemic may have thrust flexibility into the spotlight, but it is now table stakes for manufacturers that want to draw top talent. Flexibility isn’t just about remote work or adjustable schedules; workers also want to have the ability to navigate childcare and other obligations of daily life in a way that meshes well with their job. Manufacturers should assess where they may be able to improve options for workplace flexibility, for both factory floor and white-collar workers.

“Manufacturing sector respondents said the three most important factors in an ideal job would be work-life balance, support from their supervisor/boss, and the potential for advancement/promotion.”

- Compensation: Salary or wage considerations have always been one of the most important considerations for workers seeking employment, but two factors in particular right now require companies to provide competitive pay; inflation putting stress on consumer wallets and the manufacturing sector competing more and more with other industries (such as technology) for talent. Leadership teams should review compensation packages and adjust to align with the market and competitors.

- Career path: Employees do not want to remain stagnant in any position, and our survey results above indicate the importance of organizations offering employees defined career paths. For manufacturers, this might include intentional digital skills development, clear frameworks for improvement, continuing education to understand the implications of the factories of the future, and mentorship programs. Manufacturing companies should help employees chart their future within the organization based on their goals and talents.

Perhaps one of the clearest takeaways from the workforce shifts of the last three years is that employees want opportunities to be heard, and for their employers to take their feedback into consideration. Manufacturers that take a strategic approach to gathering and addressing employee feedback will have a competitive edge as the sector continues to evolve. M

Survey Methodology

The online CARAVAN® survey was conducted by Big Village among a sample of 2,017 U.S. adults ages 18 and older who are employed. Of these, 175 reported working in the manufacturing sector. Data collection occurred from Sept. 23 through Oct. 6, 2022.

About the authors:

Marni Rozen is a management consulting director at RSM US LLP.

Jason Alexander is a partner and national manufacturing sector leader at RSM US LLP.