Harnessing digital technologies to reimagine workspaces and the workforce, create more resilient operations, and refactor innovation across the enterprise will help determine which manufacturers thrive and survive in the post-COVID world.

By Sath Rao

Over just a few months, the COVID-19 pandemic has dramatically changed the rules of the game for every industry. Manufacturers in particular have found themselves in an especially challenging position. As they look toward a post-pandemic future with a potential recession on the horizon, businesses see uncertainty, worker safety, and financial and market risks as their top challenges. Different economists started predicting a virtual alphabet soup of recovery types, from U-shaped recoveries with a protracted downturn, to more rapid V-shaped recoveries, W-shaped recoveries and more. Although the outlook is unclear, the decisions that manufacturers make today will directly affect their futures.

The Need for Digital Transformation

As manufacturers gain more data on what is actually happening within their industry and on the complex interplay of policy and social response, the core of uncertainty is narrowing. It is increasingly clear that the road to recovery will be long and that there will likely be recurring challenges, rewiring of supply networks, and an urgent need to refocus on innovation. Fortunately, with a proactive approach to digital transformation1, manufacturers can not only manage these challenges effectively, they can position themselves to gain a serious competitive advantage.

Historically, when organizations face uncertainty, they slow down. That’s why it’s somewhat surprising that the responses to the needs arising from the pandemic have accelerated changes in manufacturing. Instead of getting muddled in past practices and tentative toe-dipping, businesses have rapidly embraced digital transformation and are moving aggressively to reimagine their workplaces and work practices.

“We’ve seen two years’ worth of digital transformation in two months,” noted Microsoft CEO Satya Nadella2 in his quarterly earnings report at the end of April.

The Orchestration Imperative

As discussed in The Case of the Missing Insights3 article earlier this year, enterprise transformation depends on the successful application of technology and change management to both solve business challenges and exploit new opportunities.

In today’s new landscape and with today’s market realities, the six-feet-apart economy is bringing together four key quadrants to shape the next normal. Even before the pandemic, the Human + Machine + Data + Customer Centricity formula was emerging as the force that would drive business success in the future. Spurred by the pandemic crisis, enterprises are realizing that the four key quadrants — customers, assets, partners, and employees — are converging together and data analytics is central to a systemic response.

The power of transformative technologies will be critical in achieving this operatic performance for the manufacturing industry. The next normal will require unprecedented human, machine, data, and customer-centric orchestration.

“Even before the pandemic, the Human + Machine + Data + Customer Centricity formula was emerging as the force that would drive business success in the future.”

Taking Stock of the Situation

The global pandemic has accelerated transformational changeand is having a dramatic impact on every aspect of manufacturing. A recent study by McKinsey found that 73% of manufacturers surveyed encountered problems in their supplier base as a result of the pandemic, and 75% faced problems with production and distribution. The issues were even more acute in the consumer goods and food industries, where 100% of respondents reported production and distribution problems, and 91% had problems with suppliers.

In an environment where every day brings new challenges, the effects of those challenges are far from certain. In a recent white paper5, the World Economic Forum highlights four key types of unexpected outcomes that the pandemic has revealed, including the following:

- Inflexible human resources (HR) and organizational processes, driven by a lack of collaboration and leadership, can exacerbate HR and organizational issues. Widespread infections, as well as overwork and furloughs, can also contribute to human resources pressures.

- Demand and supply imbalance, including significant supply chain delays, can hamper business agility and slow time to market. Shifts in consumption, as well as stockouts and hoarding, can also impact the balance between supply and demand.

- Constrained capital and venture capital, including lack of liquidity, can put additional financial pressures on manufacturers at a time when they require maximum flexibility. Lack of investment in flexible service technologies, a particular issue in the healthcare sector, and overly lean budgets for shop floor and supply chain technologies also undermine flexible production capacity.

- Rigid integrative systems, including restrictive legal regimes and unreliable information systems, can hamper the resilience of business and operating models. Manufacturers contend with knowledge gaps, inflexible platforms, and hierarchies that can make it difficult for them to safeguard their supply and consumption networks.

In the article Digital Innovation: Scaling for the Fast and Furious Future6, I examined the anatomy of change and made the point that, to deliver the outcomes organizations require, industrial transformation must be fully aligned with business requirements and processes. But what do you do when business requirements and processes change rapidly? Do you throw away the plans that you had originally, or do you modulate them quickly for changing ground realities? How quickly can organizations drive agility and flexibility?

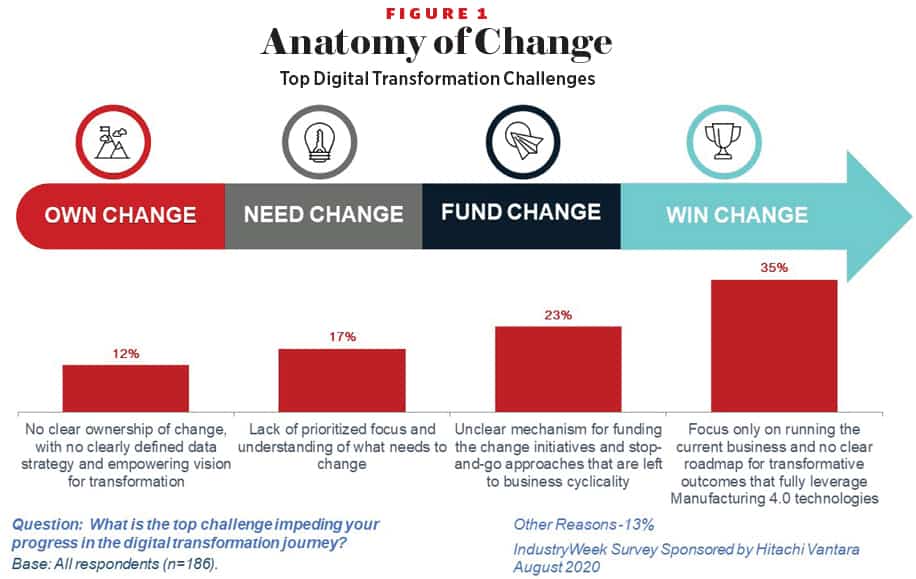

Enter the age of agile strategy and innovation. Transformative technologies have a role here, but there is a need for organizational leadership and alignment. In a recent Hitachi Vantara–sponsored IndustryWeek survey of global manufacturers, the top-rated challenge to a post-pandemic alignment for digital transformation was the lack of a clear road map that leverages technologies for transformative outcomes. As depicted in Figure 1, more than 35% of the respondents said that their organizations are floundering with only a focus on run cycles and no clear roadmap for transformative outcomes that fully leverage Manufacturing 4.0 technologies. Clearly, the mantra for the next normal will be “goal alignment for value attainment.”

“It is increasingly clear that the road to recovery will be long and that there will likely be recurring challenges, rewiring of supply networks, and an urgent need to refocus on innovation.”

Achieving More Despite Limited Control

One of the few certainties in this new world is that organizations need to learn the anatomy of change and use ameliorating levers to wield better control over their transformation journey. The manufacturing industry is very pragmatic, always finding a way to “build it better”, even with limited control over the levers of change. There are four areas where manufacturers can take proactive steps to strengthen their position.

Drive down costs: The first step is a natural one in uncertain times: reduce costs and manage liquidity. In today’s new environment, manufacturers must focus on avoiding sunk costs. Maintaining agility is especially critical. Keeping plenty of cash on hand will be necessary to ensure the ability to respond much faster to what’s happening in the marketplace.

It is important to acknowledge that some new initiatives could cause costs to go up. For example, splitting shifts and running longer hours to enforce social distancing could require more energy to produce the same amount of goods. Some of these changes will need to be made as we enter the next normal, and it is essential to plan and budget for them, while looking at alternative ways to reduce costs.

Plan for growth: To thrive in a dynamic marketplace, manufacturers need to strive to find growth opportunities, even in uncertain times. The transformation of products to services and the use of the industrial internet of things (IIoT) to drive better outcomes coupled with subscription pricing, along with driving continuous innovation and staying aligned with the needs of customers, has started to deliver repeatable revenues for many enterprises. Manufacturers should also be ready to engage customers through the channels they prefer, including digital channels.

Decrease friction and enable safety and security: Manufacturers can reduce friction by embracing convergence, taking steps to get closer to their customers, identifying and understanding changes in buying behavior, and enhancing product feedback. Embracing this convergence can enable manufacturers to achieve better customer-centricity.

Enabling safety and security must fundamentally begin with employee health and morale. Manufacturers can deploy technology to measure and monitor adherence to policies and procedures that promote health. For example, technology can be used to help ensure that people are maintaining social distancing, automatically test for elevated body temperatures, and monitor handwashing behavior, without collecting personally identifiable information (PII). Knowing policies are in place to protect their health can improve employees’ sense of security.

Cybersecurity is also important. There has been an increase in the number of cyber threats driven by rapid changes in operating procedures and the burgeoning remote workforce. A recent study determined that COVID-19–related spear phishing attacks increased by 667% from February to March, 20207. Manufacturers should put practices in place to help employees be alert for and avoid cybersecurity threats.

Improve resilience: Resilience will be at a premium in the post-COVID-19 world. Minimizing potential break points in the supply chain will help improve any operations’ resilience. Manufacturers should look for ways to enhance supplier integration and implement reshoring to improve parts availability. They can also bring suppliers closer to production lines by finding alternative suppliers in various geolocations.

Taking a control tower approach to visibility helps companies understand what is happening in the plant, across the enterprise, and across suppliers. Manufacturers should focus on mitigating demand shock and find opportunities to change capital expenditure (capex) commitments to operational expenditures (opex). For example, some manufacturers and service providers have navigated to providing products, consumables, or services on a subscription basis with predictable monthly costs. Manufacturers still want to be lean and optimize operations, but they must also be flexible and agile to adjust to rapid change while reducing inventory and stocking

Managing for the Next Normal

Exactly how an organization approaches the next normal depends on many factors, including the size and type of the organization, the shift in industry fundamentals, the position of the organization in the industrial value chain, and the organization’s financial wherewithal. However, most are responding with a digital-first approach.

For example, in the food and beverage industry, the pandemic outbreak has driven an unexpected surge in demand for aluminum cans. As bars and restaurants minimize indoor dining, beer and other beverages are increasingly sold online and in retail stores for consumption at home. Restaurants routinely purchased large kegs, but now the direct-to-consumer approach uses canned six-packs. The rapid shift has placed unprecedented strains on supply chains.

Manufacturers that can rapidly accommodate the spike in demand will be in the best position to capitalize on this new opportunity. For example, post-COVID 19, a major aluminum manufacturer recently accelerated digital partnership with Hitachi Vantara to meet the demand rises with an increased focus on quality and productivity insights. The initiative lets the firm optimize production and manage quality to keep pace with soaring demand.

New Competitive Opportunities

Although today’s pandemic has put serious strains on the fundamentals of the manufacturing economy, there is a silver lining. McKinsey8 identifies five key ways in which digital transformation can shape the post-COVID recovery:

Building operations resilience: Organizations can start by reviewing their asset strategy and considering factors like geographic footprint and the concentration of risks, then reassess their investments and transform operations for agility.

Accelerating end-to-end digitization: Ramping up digital capabilities can enhance every customer experience and boost flexibility and productivity.

Rapidly increasing capex and opex transparency: Applying digital acceleration tools can deliver improved insights that can enhance liquidity management.

Driving the future of work: Companies can make remote work the new normal through digital communication and collaboration tools. Factories are increasingly looking at enhancing automation with more remote operational technologies.

Reimagining sustainable operations as a competitive advantage: Prioritizing the customer-centric development of new products, services, and customer support models can help organizations establish collaborative ecosystems and reimagine their operations to gain a competitive edge.

“Organizations that can quickly adapt, applying digital transformation to fully align their goals for value attainment, will be better prepared for the future.”

Embracing the 3 Rs

Manufacturers across a variety of industries have learned from their experiences, and they understand that a strategy centered around data is the most effective approach to today’s challenges. As discussed in The Case of the Missing Insights, the ability to use data to generate insights9 that can actively empower customers is going to drive the next wave of competitive differentiation.

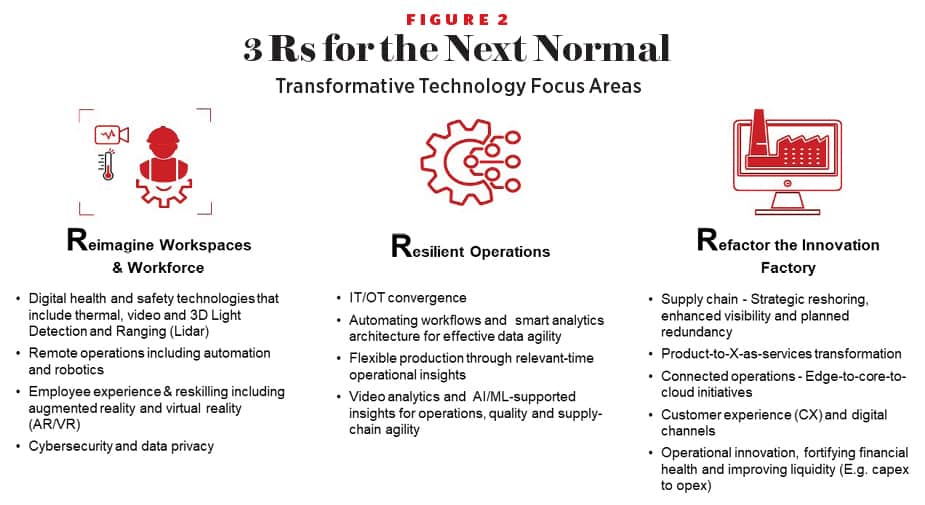

Manufacturers should respond to the next normal challenges by focusing on the themes around 3 Rs: reimagining workspaces and the workforce; evolving resilient operations; and refactoring the innovation factory (see Figure 2).

Reimagining Workspaces & Workforce

The pandemic has changed how organizations must view their workspaces and their workforce. Safety is a top priority, and it begins with worker health and morale. In the next normal, manufacturers must continue to protect employees and others on-site. This effort can be supported by using technology such as thermal imaging to check temperatures, and video and 3D lidar to monitor physical distancing and other behaviors.

For example, Hitachi Computer Products America is taking a variety of steps to mitigate COVID-19 risks, such as applying temperature screening and using an activity visualizer and alert technology to help eliminate bottlenecks in high traffic areas and optimize area utilization. The company is also using heatmap queue detection in the company cafeteria to help further minimize risk. These efforts are driving up morale and safety, while still enabling the organization to unlock dramatic cost benefits.

A reimagined workspace will undoubtedly include automation and robotics, both of which support the remote operations many factories are exploring. As automated technologies become more prevalent, they will inevitably bring workers and machines closer together. Manufacturers must take steps related to upskilling the workforce, while accelerating productivity goals. They may also want to take advantage of new opportunities for an improved employee experience, as well as reskilling, which can involve technologies such as augmented reality and virtual reality (AR/VR).

Reimagining must also include discovering and mitigating the new cybersecurity and data privacy threats that are emerging with today’s remote workforce. Manufacturers will want to reassess their cyber security posture, focusing on vulnerability management, remote endpoint security, ransomware, and advanced AI-based approaches that thwart advanced persistent threats (APT). These are critical to sustaining remote operations. They should develop processes to onboard and train employees when they are working remotely on specific tools and approaches to safeguard customer data privacy as well.

Resilient Operations

Maintaining a lean, efficient organization is imperative even during relatively stable times. In a period of dynamic change, organizations must continue to be lean, but integrate additional flexibility into operations to build resilience.

The concept of digital Kaizen is a valuable tool for creating resilience in an organization. The core principle of Kaizen is “good change” through continuous improvements that bring together humans, machines, and data orchestration. Its objective is to improve an organization, its products, processes, services, and people by applying small-scale changes on a continuous basis. Data plays a critical role in this process.

Adopting data-driven technologies that provide relevant-time operations insights, such as video analytics, artificial intelligence (AI), and machine learning (ML), can improve quality, optimize operations, and prepare manufacturers to anticipate and react to market changes. Other key catalysts for resilience include converging information technology (IT) and operational technology (OT) and creating data agility by automating workflows and creating smart analytics architectures.

For example, BMW took advantage of the challenges posed by the COVID-19 pandemic to deploy AI-powered quality control across its factories and accelerate the deployment of automation tools. While factories are shut down, the company is positioning itself to become more competitive when its operations reopen10.

Visibility is also a key to resilience. Without thorough visibility, it’s difficult for manufacturers to obtain the data needed to gain insights and make better decisions. Organizations should take steps to improve visibility across the enterprise and the supply chain, and nurture supplier integration through strategic reshoring and planned redundancy.

“Manufacturers across a variety of industries have learned from their experiences, and they understand that a strategy centered around data is the most effective approach to today’s challenges.”

Refactoring the Innovation Factory

Change remains a constant in manufacturing, so organizations must refactor to benefit from convergence.

Refactoring the innovation factory cuts across every aspect of the organization and focuses on rapidly revaluating existing technology and transformation initiatives, and a recommitment to areas where a compelling competitive advantage can be created for the next normal. In the financial arena, for example, manufacturers should take steps to fortify the organization’s financial health by improving liquidity to support capex and opex. Initiatives to increase digital channels, reduce inventory, and build edge-to-core-to-cloud capability can drive a positive impact on liquidity. A focus on strategic reshoring, enhanced visibility, and planned redundancy can help businesses refactor their supply chains.

Leveraging technologies at scale is also fundamental to refactoring. Combining existing and new technologies can be a winning combination for reducing risks and protecting workers.11 By bringing together cloud services, analytics, and insights, manufacturers can gain the context, understanding, and efficiencies they need to fully optimize their operations.

Investing in the customer experience is a critical piece of this puzzle. Organizations need to identify and understand changes in buying behavior and support the customer by introducing as-a-service models that help the customer adapt to fluctuating needs and revenue streams during times of crisis. Being closer to customers and bringing them into the design process ensures that the business is aware of changing needs and behaviors as they arise.

For example, Starbucks is taking advantage of a robust mix of cloud technology and mobile apps to support rich connectivity between its stores, equipment, and customers. The combination has proven to be highly effective at helping the organization deliver a positive customer experience even in the midst of the current pandemic. Customers can place their orders and pay in advance using the company’s app, and they can pick up their order in a contactless drive-thru or at a retail location’s door. By applying continuous insights based on data, Starbucks will continually expand and adjust the customer experiences it enables in stores, based on a clear decision-making framework.12 The manufacturing industry can learn from the forward-looking practices of retail organizations like this. Data must be central to the transformation and must include digital channels.

Innovating for the Next Normal and Beyond

Although the challenges of today’s crisis are daunting, they are also creating an unprecedented opportunity for forward-looking manufacturers to seize momentum and drive transformative competitive advantage. Organizations that can quickly adapt, applying digital transformation to fully align their goals for value attainment, will be better prepared for the future.

Manufacturers that can capitalize on evaluating the 3 Rs and incorporating use cases as part of their road map for transformation will be best equipped to not only survive the challenges but differentiate themselves by providing a superior customer experience. Those that are unable to keep pace with innovation, risk being left behind. M

1 Sath Rao, “Digital Innovation: Scaling for the Fast and Furious Future,” Manufacturing Leadership Journal, April 2020, https://www.manufacturingleadershipcouncil.com/2020/04/10/digital-innovation-scaling-for-the-fast-and-furious-future/

2 Jared Spataro, “2 Years of Digital Transformation in 2 Months,” Microsoft 365 (blog), April 30, 2020, accessed August 10, 2020, https://www.microsoft.com/en-us/microsoft-365/blog/2020/04/30/2-years-digital-transformation-2-months/

3 Sath Rao, “The Case of the Missing Insights,” Manufacturing Leadership Journal, October 2019, https://www.manufacturingleadershipcouncil.com/2019/10/04/the-case-of-the-missing-insights/

4 Knut Alicke, Richa Gupta and Vera Trautwein, “Resetting Supply Chains for the Next Normal,” McKinsey & Company, July 21, 2020, https://www.mckinsey.com/business-functions/operations/our-insights/resetting-supply-chains-for-the-next-normal

5 Joglekar N., Parker G., and Srai J. S., “Winning the Race for Survival: How Advanced Manufacturing Technologies Are Driving Business-Model Innovation,” https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3604242

6 Sath Rao, “Digital Innovation.”

7 Fleming Shi, “Threat Spotlight: Coronavirus-Related Phishing,” Barracuda, March 20, 2020, https://blog.barracuda.com/2020/03/26/threat-spotlight-coronavirus-related-phishing/

8 Edward Barriball, Katy George, Ignacio Marcos and Philipp Radtke, “Jump-Starting Resilient and Reimagined Operations,” McKinsey, May 11, 2020, https://www.mckinsey.com/business-functions/operations/our-insights/jump-starting-resilient-and-reimagined-operations

9 Sath Rao, “The Case of the Missing Insights.”

10 David Uberti, “How BMW Used Pandemic Plant Stoppages to Boost Artificial Intelligence,” The Wall Street Journal, July 28, 2020, https://www.wsj.com/articles/how-bmw-used-pandemic-plant-stoppages-to-boost-artificial-intelligence-11595939400?mod=djemAIPro

11 Rajesh Devnani and Justin Bean, “Health and Safety of Workers,” Hitachi, https://social-innovation.hitachi/en-us/think-ahead/manufacturing/health-and-safety-of-workers/

12 Chris Walton, “3 Ways Starbucks Will Emerge from COVID-19 Stronger Than Before,” Forbes, April 3, 2020, https://www.forbes.com/siteschristopherwalton/2020/04/03/3-ways-starbucks-will-emerge-from-covid-19-stronger-than-before/#1d89d6641844